Why This Guide?

- Step-by-Step Instructions: Perfect for beginners and those ready to level up.

- Actionable Insights: No complicated jargon—just practical, real-world advice.

- Comprehensive Tools & Resources: Budget templates, investment strategies, and more!

Ready to Start Building Wealth?

Don’t wait for the perfect moment. Take control of your financial future today!

👉 Download the Guide Now!

Here’s what you’ll learn from this guide:

- How to Build & Scale Multiple Income Streams:

Discover practical ways to create additional income sources, from freelancing and side hustles to passive income strategies. - Investment Basics Made Simple:

Learn how to invest wisely in stocks, real estate, cryptocurrency, and more—without complicated financial jargon. - Time Management for Maximum Earning Potential:

Master the art of automating and outsourcing tasks so you can earn money even when you’re not working. - Financial Planning & Wealth Building:

Create a long-term financial plan, save smartly, and build generational wealth for your future. - Risk Management & Diversification:

Learn how to manage risks across different income streams and diversify your portfolio for long-term growth. - Actionable Steps to Start Right Away:

Whether you’re a beginner or looking to level up, this guide provides you with practical, easy-to-follow steps to start building wealth now.

Why Buy This Guide?

- Actionable Steps, Not Just Theory:

This guide provides real, step-by-step strategies that you can start using immediately to create and grow multiple income streams. - Perfect for All Levels:

Whether you’re just starting out or looking to diversify your current income, this guide is packed with beginner-friendly advice and advanced tips to help you succeed. - No Complicated Jargon:

We’ve broken down complex financial concepts into simple, easy-to-understand language, so anyone can follow along. - Proven Strategies for Financial Freedom:

Learn tried-and-tested methods for building passive income, investing wisely, and managing your money to secure long-term financial success. - Tools, Templates & Resources Included:

You’ll get exclusive access to budget templates, investment guides, and more to help you put these strategies into action right away. - Learn from Real-Life Examples:

The guide is filled with practical, real-world examples to inspire and motivate you, showing how others have successfully built multiple income streams. - Your Roadmap to Financial Independence:

This isn’t just a guide—it’s a complete roadmap to achieving financial freedom, giving you the power to take control of your financial future.

Here’s what you’ll learn from this guide:

- How to Create and Grow Multiple Income Streams:

Learn practical ways to increase your earnings, from freelancing and side hustles to building passive income. - Investment Basics Made Simple:

Understand how to invest in the stock market, real estate, and cryptocurrency without any complicated financial terms. - Time Management and Maximizing Your Earnings:

Discover how to automate and outsource tasks so you can earn money even when you’re not working. - Financial Planning and Wealth Building:

Create a long-term financial plan and grow your wealth through smart saving and investing strategies. - Risk Management and Diversification:

Learn how to manage risks across different income streams and diversify your portfolio for long-term growth. - Actionable Steps You Can Apply from Day One:

Whether you’re a beginner or experienced, this guide offers easy-to-follow steps to help you start your financial journey today.

Table of Contents

Introduction

- Why Multiple Income Streams?

- Benefits of Diversified Income

- Risks of Relying on a Single Source

- Overview of Passive vs Active Income

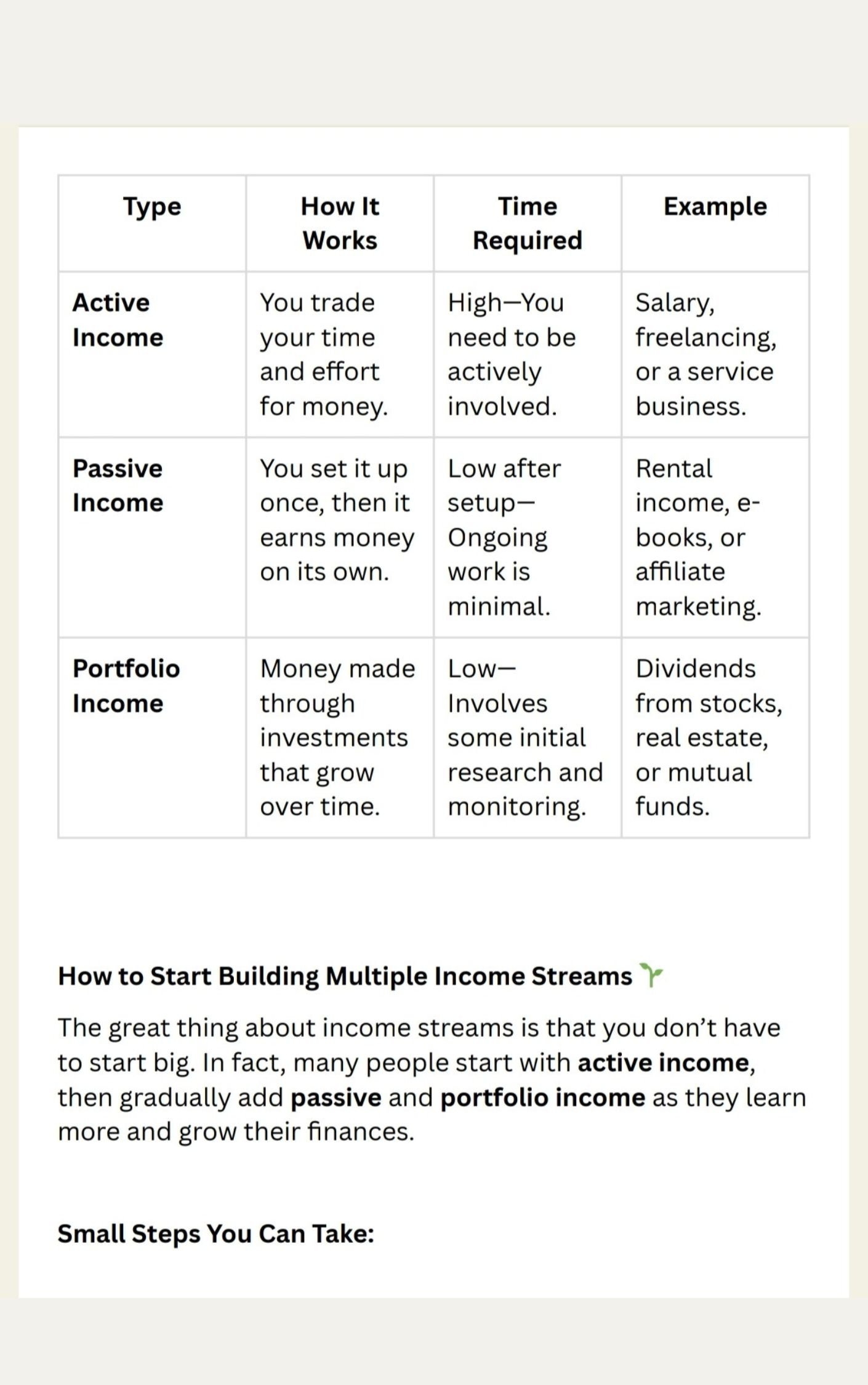

Chapter 1: Understanding Income Streams

- What are Income Streams?

- Types: Active, Passive, Portfolio

- Key Differences and Examples

- Mindset Shift: From Employee to Entrepreneur

- Changing the Way You Think About Money

- Building Wealth vs Earning a Salary

Chapter 2: Laying the Foundation

- Personal Finance Basics

- Creating a Budget

- Saving and Investing 101

- Emergency Fund: Why It’s Crucial

- Skill Development

- Identifying Marketable Skills

- Learning New Skills for New Income Streams

- Certification and Online Learning Platforms

Chapter 3: Active Income Streams

- Freelancing and Consulting

- How to Get Started

- Platforms for Freelancing (Upwork, Fiverr, etc.)

- Scaling Your Freelance Income

- Starting a Service-Based Business

- Business Ideas with Low Startup Cost

- Building a Client Base

- Growing a Service Business

- Side Hustles You Can Start Today

- Blogging, Vlogging, Podcasting

- Selling Products Online (Etsy, eBay, Amazon)

- Teaching and Coaching (Online Courses, Tutoring)

Chapter 4: Passive Income Streams

- What is Passive Income?

- Myth vs Reality

- How to Build Sustainable Passive Income

- Investment Opportunities

- Stock Market: Dividends, ETFs, Mutual Funds

- Real Estate Investment

- Peer-to-Peer Lending, REITs, and Crowdfunding

- Digital Products

- Creating and Selling E-books

- Online Courses and Membership Sites

- Affiliate Marketing and Sponsored Content

Chapter 5: Portfolio Income Streams

- Building an Investment Portfolio

- Asset Allocation: Stocks, Bonds, and Alternative Investments

- Diversifying Your Portfolio

- Long-Term Growth and Capital Appreciation

- Cryptocurrency and New-Age Investments

- Understanding Blockchain

- Investing in Bitcoin, Ethereum, and Altcoins

- Risks and Rewards

Chapter 6: Scaling Your Income

- Automation and Outsourcing

- Automating Your Income Streams

- Outsourcing Tasks to Free Up Time for Scaling

- Tools and Resources for Productivity

- Leveraging Your Network

- Collaborations and Partnerships

- How to Attract Bigger Opportunities

- Mentorship and Masterminds

- Building Multiple Streams Simultaneously

- Time Management and Focus

- Managing Risk Across Different Streams

- Balancing Active and Passive Income Sources

Chapter 7: Protecting and Sustaining Wealth

- Tax Strategies for Multiple Income Streams

- Understanding Tax Brackets and Deductions

- How to Legally Minimize Your Tax Burden

- Hiring a Tax Professional

- Financial Planning and Estate Management

- Creating a Long-Term Financial Plan

- Building Generational Wealth

- Trusts, Wills, and Succession Planning

Conclusion

- The Road to Financial Freedom

- Setting Clear Financial Goals

- Staying Consistent and Patient

- The Importance of Continuous Learning and Adaptation

- Your Next Steps

- Building Your First Income Stream

- Scaling and Diversifying Your Wealth

- Staying Resilient in the Face of Challenges

Appendices

- Resource List: Books, Tools, Websites for Income Generation

- Budget and Investment Templates

- Action Plans for Each Chapter

This guide is available as an **eBook** (electronic book). You can read it on your mobile, tablet, computer or any electronic device. So wherever you are, you can easily access it and start your financial journey!

Reviews

There are no reviews yet.